Calculating student loan payments fannie mae

The loan-to-value ratio LTV ratio is a lending risk assessment ratio that financial institutions and others lenders examine before approving a mortgage. How are student loan payments calculated if the monthly income-driven repayment plan is 0.

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Effective On 9 18 21 Fannie Mae Announced That Their Automated Underwriting System Will Now Take An Average Of The

New Credit 10 When calculating scores.

. Fannie Mae does not require lenders to review or document income from secondary sources when that income is not needed to qualify. The payments on a federal income tax installment agreement can be excluded from the borrowers DTI ratio if the agreement meets the terms in Debts Paid by Others or. Calculating Deferred Loan Payments.

Financial Information Assets and Liabilities 2a. Even though this payment could be deferred for several years Fannie Mae wants lenders to make sure the borrower can afford the mortgage payment with the student loan. Loan-To-Value Ratio - LTV Ratio.

Other monthly debt payments. Assets-Bank Accounts Retirement and Other Accounts You Have. No max DTI specified but borrowers with higher DTI could be subject to additional scrutiny.

This new process should. Business-related debt for which the borrower or co-borrower is personally obligated would likely be on their credit report and therefore already included in the debt-to-income DTI ratio. Derogatory Student Loan Debt Scenario.

To calculate your debt-to-income ratio add up your total recurring monthly obligations such as mortgage student loans auto loans child support and credit card payments and divide by your. Student Loan Payments. Thats great news for anyone thats been a reliable tenant for years while saving for a house.

When the mortgage that will be delivered to Fannie Mae also has a home equity line of credit HELOC that provides for a monthly payment of principal and interest or interest. Average prime offer rate. 45 to 50 FHA loans.

Fannie Mae recently announced changes to their underwriting process. Fannie Mae booked net income of 46 billion in the second quarter of this year down 35 percent from the 72 billion it earned in the second quarter of 2021. Trying to qualify for a home mortgage can get a little sticky if you have a large number of outstanding student loans.

Fannie Mae allows lenders to use one of two methods when determining the required payment on a deferred loan. Even if you previously had a mortgage application rejected you may want to try again. As our previous research has shown ICT projects deviate from their initial cost estimate by more than 10 in 8 out of 10 cases.

The new calculations will include your history of rental payments. The term average prime offer rate is defined in 102635a2. For example if you only have revolving lines of credit like credit cards consider applying for a small personal loan and making on-time payments.

Student loan is in collection or garnishment. Topic Topic Name See Page 1 How to Underwrite a VA-Guaranteed Loan 4-2 2 Income 4-6 3 Income Taxes and Other Deductions from Income 4-25 4 Assets 4-27 5 Debts and Obligations 4-29 6 Required Search for and Treatment of Debts Owed to the Federal Government 4-34 7. Back-end DTI limit.

Fannie Mae and Freddie Mac reported significantly lower net income in the second quarter compared with the same period a year ago. Fannie Mae and Freddie Mac Government-Sponsored Enterprises GSE which package residential mortgages into securities allow higher debt levels for homebuyers with a significant student debt load. The Iron Triangle formulates the holy trinity of objectives of project management cost schedule and benefits.

50 VA loans. Fannie Mae conventional is now your only IBR option in 2018. Conventional Loan 3 Down Available Via Fannie Mae Freddie Mac April 8 2015 3 Down payment mortgages for first-time home buyers April 21 2022 Do bi-weekly mortgage programs pay your mortgage.

Enter the email address you signed up with and well email you a reset link. Your student loan debt will be 050 with Freddie Mac and Fannie Mae of your student loan balance to use as a monthly payment. Instructions for Completing the Uniform Residential Loan Application Uniform Residential Loan Application Instructions 4 Freddie Mac Form 65 Fannie Mae Form 1003 URLA Effective 92020 Instructions Revised 32020 Section 2.

In this Chapter This chapter contains the following topics. Conventional loans backed by Fannie Mae and Freddie Mac. It makes sense since.

HUD came up with updated student loan guidelines where they now accept. As long as the lender can provide documentation showing the IDR payment is 0 they can qualify the borrower with 0 for the monthly qualifying payment. Underwriters can take 050 of outstanding student loan balance on deferred student loans.

High-cost mortgages include closed- and open-end consumer credit transactions secured by the consumers principal dwelling with an annual percentage rate that exceeds the average prime offer rate for a comparable transaction as of the date the interest rate is set by the specified amount. If your payments are deferred or the loan is in forbearance you must use 1 of the loan balance when calculating your debt to income ratio. FHA student loan guidelines allow for IBR payments.

2

Fannie Mae Mortgage Student Loans Find My Way Home

Fannie Mae 2022 Rules For Student Loan Payments Are Calculated In Your Debt To Income Ratio Arrivva

Fannie Mae Student Loan Guidelines Find My Way Home

Fannie Mae Loan Purchase Letter Faqs Know Your Options

Student Loan Debt Mortgage Qualifying Home Buying

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Effective On 9 18 21 Fannie Mae Announced That Their Automated Underwriting System Will Now Take An Average Of The

Getting A Mortgage While On Income Based Repayment Ibr

How To Qualify For A Mortgage With Student Loan Debt Mortgage Blog

Guidelines Changes On Student Loans For Conventional Fannie Mae Usda Fha And Va Mortgage Loans In Kentucky Mortgage Loans Student Loans Va Mortgage Loans

Fannie Mae Guidelines For Calculating Student Loan Deferment Mortgage Info

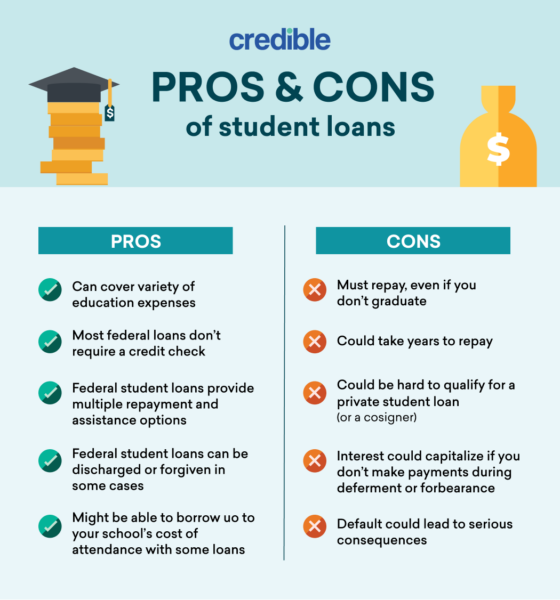

The Pros And Cons Of Student Loans Are They Worth It Credible

Fannie Mae Revised Guidelines For Student Loans Debt Payment And Refinances Greenway Mortgage Blog

How Income Based Repayments On Student Loans Affect Your Mortgage

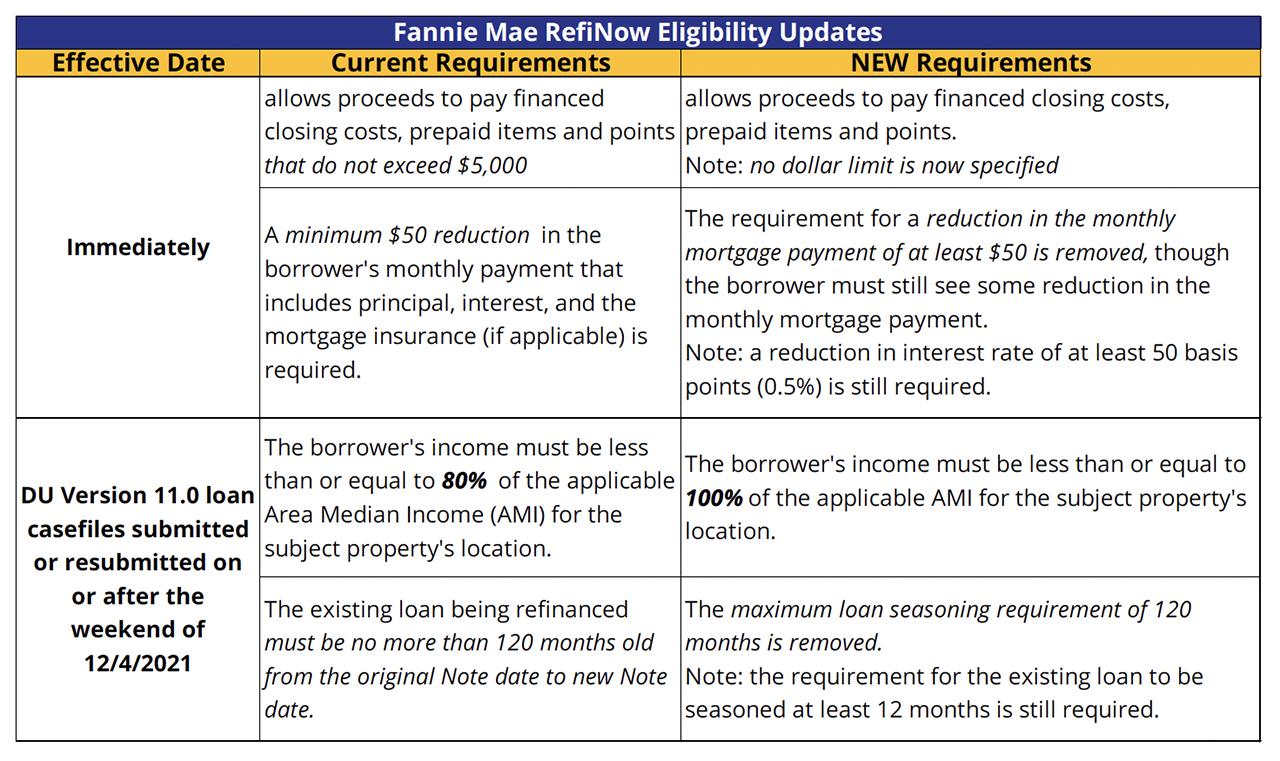

21 92 Fannie Mae Ll 2021 10 Expanding Refinance Eligibility With Refinow Pcg

2022 Guide To Qualifying For A Mortgage With Student Loans Find My Way Home

2